by Mary Margaret Olohan

Missouri Republican Sen. Josh Hawley introduced a bill Monday aimed at providing support for families with young children.

Hawley’s plan would give single parents with children under 13 $6,000 in parent tax credits and married parents with children under 13 $12,000 in parent tax credits, according to a press release.

“Starting a family and raising children should not be a privilege only reserved for the wealthy,” Hawley said in a statement. “Millions of working people want to start a family and would like to care for their children at home, but current policies do not respect these preferences.”

“American families should be supported, no matter how they choose to care for their kids,” Hawley said.

“American families should be supported, no matter how they choose to care for their kids,” Hawley said.

We need a plan to help working parents that is pro-family and pro-work. I’ll be proposing legislation this coming week that gives a major tax cut to working parents to help them afford to start a family and raise their kids https://t.co/gbZXxXI58T

— Josh Hawley (@HawleyMO) April 25, 2021

The Parent Tax Credit would be a fully refundable tax credit provided to families through automatic monthly advances, Hawley’s office said in a press release.

“Although most American families believe children are better off when one parent stays home to care for them, current federal childcare programs and policies force both parents into the labor market and require children be enrolled in formal commercial childcare,” the press release said.

Single-parent households will have to report prior year earnings that are greater than or equal to an earnings threshold of $7,540, or 20 hours per week of work at the federal minimum wage. Married parents who file a joint tax return must meet the same earnings threshold, according to Hawley’s office — a requirement that “creates an explicit marriage bonus of 100 percent.”

– – –

Mary Margaret Olohan is a reporter at Daily Caller News Foundation.

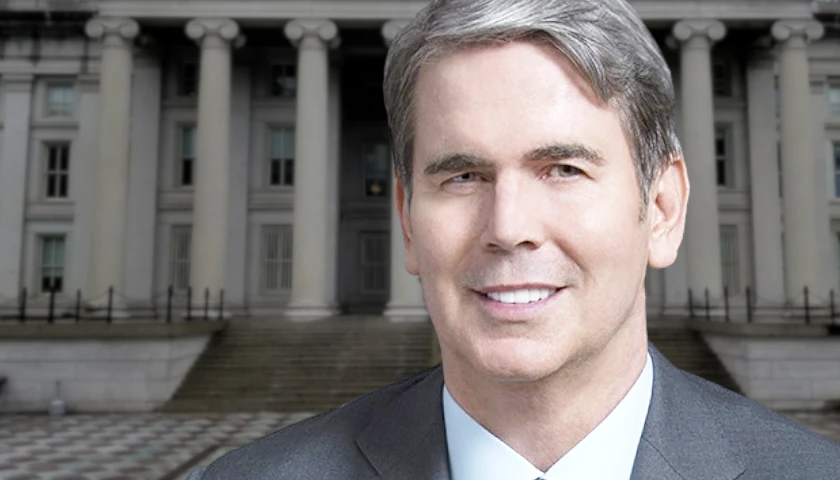

Photo “Josh Hawley” by Natureofthought CC 4.0.